Executive Summary (Key Takeaways)

- Virtual biotech and early-stage startups face unique CMC execution risks due to lean teams, outsourced models, and accelerated investor timelines

- Strategic CMC Services for Biotech Startups must focus on decision-ready data, regulatory-grade documentation, and scalable manufacturing pathways

- Early CMC missteps can permanently damage valuation, delay IND filings, or trigger FDA clinical holds

- Virtual companies require integrated CMC governance across CDMOs, analytical labs, and regulatory consultants

- Right-sized CMC strategies balance speed, cost, and long-term commercial viability

- Purpose-built CMC Services for Biotech Startups enable capital efficiency while maintaining regulatory credibility

Introduction

For virtual biotech and early-stage companies, CMC Services for Biotech Startups are not just a routine requirement. They are a key value driver that directly affects funding, regulatory success, and future growth. Unlike large pharmaceutical companies, startups must manage Chemistry, Manufacturing, and Controls activities without internal labs, manufacturing plants, or large technical teams.

These companies are under constant pressure to reach major milestones such as IND submission, first-in-human trials, or Series A and B funding rounds. Each milestone is closely examined for CMC readiness, data quality, and execution strength. Weak CMC foundations can quickly weaken even the most promising science.

Expert Guidance: Explore our full range of Chemistry, Manufacturing, and Controls (CMC) Services

This article explains how CMC support should be designed specifically for virtual biotech and early-stage startups. The focus is on real execution challenges, regulatory expectations, and practical risk reduction rather than generic or theoretical CMC models.

Why CMC Services for Biotech Startups Must Be Structured Differently

CMC Services for Biotech Startups must be highly execution-focused from day one because early technical choices become part of regulatory filings. Unlike large pharma companies, startups usually do not have the budget or time to redesign processes after Phase 1 without major delays or added costs.

Early-stage companies also face unique structural limits that shape their CMC approach. These limits influence how development work is planned, documented, and carried out. Decisions made in preclinical and early clinical stages often determine whether later development is even possible.

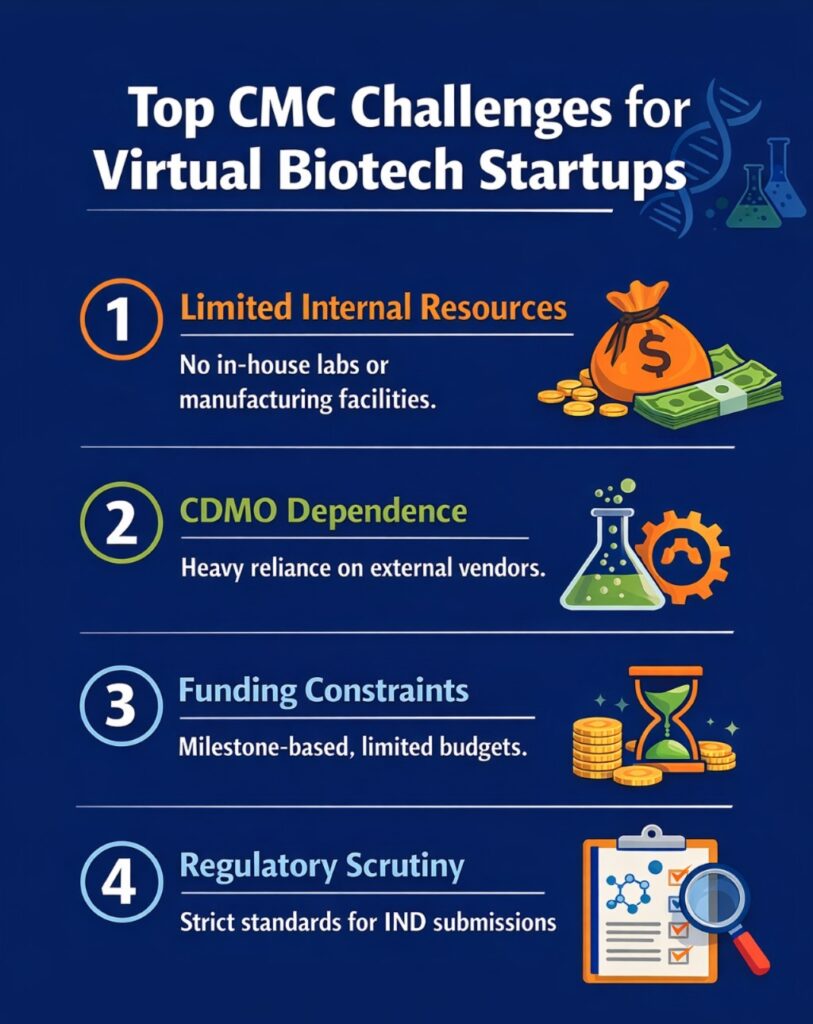

Key structural differences include:

- No internal manufacturing or analytical laboratories

- Heavy dependence on external CDMOs and CROs

- Limited funding with milestone-based financing

- Regulatory submissions built step by step over time

Because of these factors, CMC strategies must focus on right-first-time documentation, strong vendor coordination, and risk-based development plans that already consider future regulatory needs.

Plan Your Roadmap: Discover how a specialized IND CMC Strategy reduces early-stage risk

CMC Services for Biotech Startups in Virtual Operating Models

In virtual biotech companies, CMC Services for Biotech Startups act like an external technical department. The purpose is not only to generate data, but also to ensure that all outsourced work is aligned, consistent, and ready for regulatory review.

In a virtual setup, data is generated across several vendors, often using different systems and standards. Without strong CMC leadership, this can lead to fragmented datasets and conflicting information during regulatory submissions.

Key responsibilities include:

- Converting development goals into clear CDMO work packages

- Making sure analytical methods meet current regulatory expectations

- Keeping consistency across drug substance, drug product, and stability data

- Preventing unnecessary work and scope creep from vendors

Without proper oversight, startups risk building disconnected data packages that do not fully support IND submissions or regulatory questions.

Partner for Success: Learn more about our CMC CRO Services for virtual teams

Early-Stage CMC Strategy: Designing for IND Without Overbuilding

CMC Services for Biotech Startups must carefully balance speed with future readiness. Over-designing early processes wastes limited capital, while under-designing creates regulatory risks that appear later and are harder to fix.

A strong early-stage CMC strategy focuses on what is truly required for IND approval while keeping options open for future phases. The aim is to meet regulatory expectations without locking the program into inefficient or non-scalable solutions.

Key priorities include:

- Phase-appropriate and scientifically justified specifications

- Formulation strategies aligned with platform technologies where possible

- Scalable synthesis or expression routes that support growth

- Analytical methods that can evolve toward full validation

Table: Phase-Appropriate CMC Decision Framework

| CMC Element | Preclinical / IND | Phase 1–2 | Phase 3 Readiness |

|---|---|---|---|

| Specifications | Justified ranges | Tightened | Commercial |

| Process Controls | Critical only | Expanded | Fully validated |

| Analytical Methods | Qualified | Partially validated | Validated |

This staged approach is a core principle of effective CMC Services for Biotech Startups, helping companies stay efficient while maintaining regulatory strength.

Navigate Requirements: Compare IND vs NDA CMC Requirements to optimize your development

Regulatory-Grade Documentation: A Non-Negotiable for Startups

CMC Services for Biotech Startups must deliver regulatory-quality documentation from the earliest stages. Regulatory agencies do not lower their expectations based on company size, funding level, or virtual business models.

Poor or incomplete documentation is a common reason for IND delays and regulatory questions. In serious cases, it can result in clinical holds that require extensive corrective work.

Key documentation requirements include:

- Clear and consistent Module 3 content for IND submissions

- Development reports supported by sound scientific reasoning

- Clear links between analytical methods, specifications, and batches

- Strong data integrity across all outsourced partners

High-quality documentation reduces regulatory risk and supports smoother interactions with health authorities.

Ensure Compliance: Get expert support for IND CMC Services and dossier preparation

Managing CDMOs: The Hidden Risk in CMC Services for Biotech Startups

One of the biggest hidden risks in CMC Services for Biotech Startups is unmanaged reliance on CDMOs. While CDMOs are critical execution partners, they do not own the overall regulatory or product lifecycle strategy.

Without clear guidance, CDMOs may focus on internal efficiency rather than long-term program success. This can result in misaligned outputs, unnecessary work, or missing regulatory elements.

Effective CMC oversight ensures:

- Clear and complete technology transfer packages

- Defined acceptance criteria and performance metrics

- Independent review of technical data and reports

- Alignment across all vendors and development activities

Without centralized control, problems often appear only during regulatory submission preparation, when fixes are most costly.

Substance Control: Optimize your Drug Substance Chemistry, Manufacturing, and Controls

Analytical Strategy: The Backbone of CMC Credibility

CMC Services for Biotech Startups must place strong emphasis on analytical strategy, as analytics support nearly every regulatory claim. Stability data, specifications, comparability, and batch release all depend on reliable analytical methods.

Weak analytical systems can reduce confidence in both clinical results and manufacturing processes. Regulators and investors increasingly view analytical maturity as a sign of organizational strength.

Key elements include:

- Stability-indicating methods based on known degradation risks

- Proper qualification and control of reference standards

- Planning for method lifecycle from early phases to commercialization

- Readiness for method transfer between laboratories

A solid analytical strategy strengthens regulatory confidence and supports long-term success.

Investor and Partner Due Diligence: CMC as a Valuation Driver

CMC Services for Biotech Startups have a direct impact on company valuation during fundraising and partnering discussions. Experienced investors routinely evaluate CMC risks alongside clinical data.

Unclear or weak CMC strategies raise concerns about scalability, cost control, and execution capability. These concerns can affect deal terms or delay partnerships.

Common due diligence questions include:

- Can the manufacturing process scale without major changes?

- Are specifications well justified and defensible?

- Is there a clear path to commercial manufacturing?

- Do CMC timelines align with clinical plans?

Strong CMC execution lowers perceived risk and improves deal outcomes.

CMC Services for Biotech Startups Preparing for Scale-Up and Tech Transfer

Even in early development, CMC Services for Biotech Startups must consider future scale-up needs. Early technical decisions can limit manufacturing options later if not carefully planned.

Forward-looking CMC planning reduces costly redevelopment during late-stage transitions and supports smoother partner changes.

Key considerations include:

- Avoiding unnecessary dependence on proprietary vendor systems

- Choosing materials with stable and reliable supply chains

- Designing processes compatible with multiple CDMOs

- Documenting development decisions for future tech transfers

This approach protects long-term program value.

Technical Excellence: See our Analytical Method Development for IND and NDA

Common CMC Pitfalls in Virtual Biotech Companies

CMC Services for Biotech Startups aim to prevent common and avoidable failures. Many early-stage programs struggle due to underestimating CMC complexity.

Frequent pitfalls include:

- Treating CMC as a checklist instead of a strategy

- Letting CDMOs drive development decisions

- Delaying analytical rigor until late stages

- Inconsistent documentation across vendors

- Lack of clear ownership for regulatory CMC activities

These issues grow more serious as development progresses and become harder to correct.

Avoid Setbacks: Understand common CMC Deficiencies in IND & NDA submissions

Conclusion: Why Strategic CMC Services for Biotech Startups Are Non-Optional

For virtual biotech and early-stage companies, CMC Services for Biotech Startups are essential, not optional. The quality of CMC execution directly affects regulatory approval, investor trust, and future scalability.

Startups that invest early in structured, regulatory-ready CMC support move faster, raise capital more efficiently, and avoid costly delays and rework. In a competitive and resource-limited biotech environment, a strong CMC strategy is a powerful advantage.

Still have questions? Read our Chemistry, Manufacturing, and Controls (CMC) Services FAQs

Contact ResolveMass Today – Contact us

Frequently Asked Questions (FAQs)

Biotech startups usually operate without internal labs or manufacturing sites and depend heavily on outsourced partners. They also work with limited budgets and tight timelines. Because of this, CMC Services for Biotech Startups must be more flexible, execution-focused, and risk-aware compared to big pharma models.

CMC support should ideally begin during preclinical development, even before IND-enabling studies start. Early involvement helps guide smart technical decisions, avoids rework, and ensures regulatory expectations are met from the beginning.

One of the most common mistakes is postponing proper documentation and analytical rigor until the IND stage. This often leads to regulatory questions, delays, or costly corrective work later in development.

Scalability should be considered from the very first process design, even for Phase 1 materials. Early decisions strongly influence future manufacturing options and can either enable or limit growth.

Effective management requires centralized CMC governance and clear technical oversight. This ensures consistency across vendors, prevents data gaps, and keeps all partners aligned with regulatory goals.

Reference

- Popkin, M. E., Goese, M., Wilkinson, D., Finnie, S., Flanagan, T., Campa, C., Clinch, A., Teasdale, A., Lennard, A., Cook, G., & Mohan, G. (2022). Chemistry manufacturing and controls development, industry reflections on manufacture, and supply of pandemic therapies and vaccines. AAPS Journal, 24(6), Article 101. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC9514697/

- Patel, D. H., Kumar, B. J., & Patel, A. A. (2017). Preparation and review of chemistry, manufacturing and control (CMC) sections of CTD dossier for marketing authorization. International Journal of Drug Regulatory Affairs, 5(2), 1–12. https://www.ijdra.com/index.php/journal/article/view/196

- U.S. Food and Drug Administration. (2024, November 19). Chemistry manufacturing and controls (CMC) guidances for industry (GFIs) and questions and answers (Q&As). U.S. Department of Health and Human Services. https://www.fda.gov/animal-veterinary/guidance-industry/chemistry-manufacturing-and-controls-cmc-guidances-industry-gfis-and-questions-and-answers-qas